Over the years, I’ve had many friends and family get sucked into business opportunities that sounded too good to be true. It always starts the same way – they get approached by an enthusiastic person claiming they can make huge amounts of money by joining this amazing new business venture. The details are usually vague, but the promise of getting rich quickly is used as bait to lure in unsuspecting recruits. Once hooked, participants are convinced to invest more and more money while recruiting new members themselves. Eventually, when the scheme collapses and the cash stops flowing upward, most people end up losing everything. Read on to learn what characterizes a pyramid scheme according to the law, why they usually fail, and tips to help avoid being seduced by their false promises of easy wealth.

What Defines a Pyramid Scheme Legally?

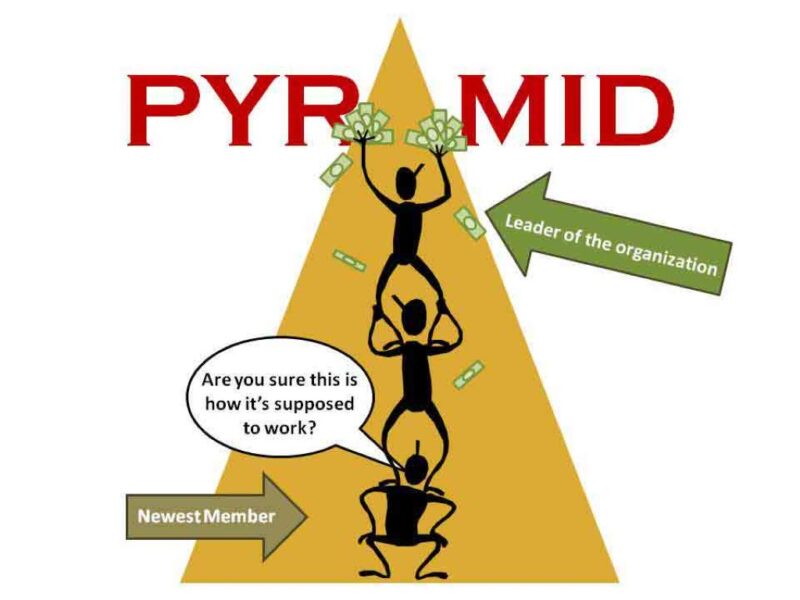

While pyramid schemes market themselves as legitimate businesses and investment opportunities, they are actually illegal in the United States and many other countries. The U.S. Federal Trade Commission (FTC) defines a pyramid scheme as a fraudulent system of making money that mainly relies on recruiting an endless chain of new members. According to the FTC, the hallmarks of a pyramid scam include:

- New participants are required to pay money upfront to join, usually through a membership fee or by purchasing products or services.

- Members are encouraged or even pressured to recruit new participants from their own networks.

- The focus is on recruitment rather than the sale of products or services to genuine consumers.

- Rewards or profits are tied not to product sales, but to the continual growth of the pyramid through signing up more new members.

- The system is not sustainable long-term and will inevitably collapse when recruitment of new members slows or stops. This leaves most participants who joined late losing their investments.

While pyramid schemes may try to disguise themselves as legitimate businesses by offering products or services, their profits really come from expanding the member base rather than actual sales. Without continually recruiting more people, the entire structure has no way to generate funds and must eventually fail.

Why Do Most Pyramid Schemes Inevitably Collapse?

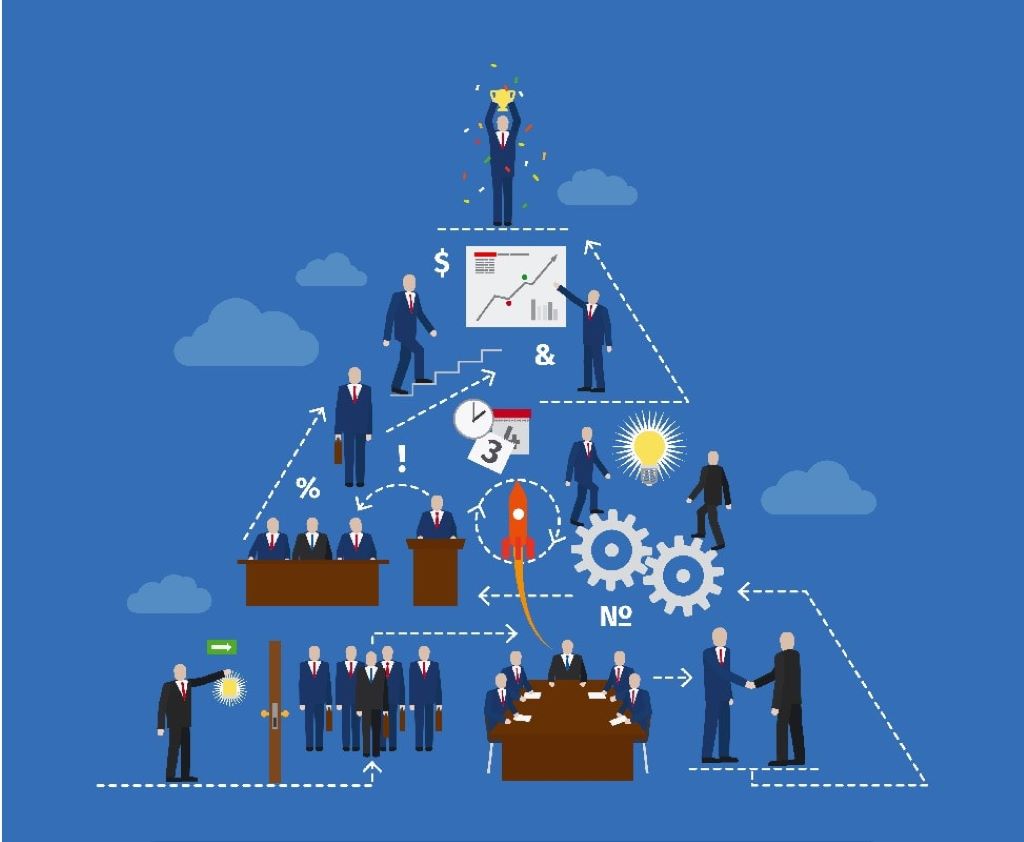

Pyramid schemes lure in unsuspecting recruits with promises of getting rich by capturing a share of the supposed wealth flowing upward from an ever-expanding base of new participants. However, this entire system is fundamentally unsustainable. Once the pool of potential new members is exhausted, the pyramid inevitably collapses. Here are some key reasons why pyramid schemes can never deliver long-term, sustainable value:

Saturation of the Market

All pyramid schemes rely on continuously recruiting new members from the public to sustain themselves. But there is an upper limit on how many people can realistically be brought in at the entry levels. Once that saturation point is reached, it becomes impossible to recruit more new members, and the pyramid collapses.

Inability to Retain Members

The pyramid structure means that the large majority of participants will always be at the bottom levels. Since profits really come from expanding membership rather than true product sales, those at lower levels barely make any money. Ultimately most people will become disillusioned and drop out when their income fails to materialize, accelerating the scheme’s collapse.

Legal and Regulatory Bans

Once recognized as illegal scams, pyramid schemes will face scrutiny from legal authorities and regulators. Getting shut down through legal intervention can cause these schemes to come crashing down overnight.

Dependence on Endless Growth

The constant demand for new members means pyramid schemes face a “grow or die” imperative. But since endless exponential growth is impossible in reality, the system cannot be sustained indefinitely. Hitting an inevitable ceiling leads to breakdown of the entire pyramid structure.

While pyramid promoters will offer visions of unlimited wealth and income, the underlying economics mean that failure is baked into the structure. Recognizing these realities can help avoid getting fooled by empty promises.

Warning Signs You May Be Dealing With a Pyramid Scheme

Pyramid schemers are masters at using false promises of easy money to reel in unsuspecting recruits. But there are often red flags that can tip you off that an “opportunity” is really just a thinly disguised pyramid scam:

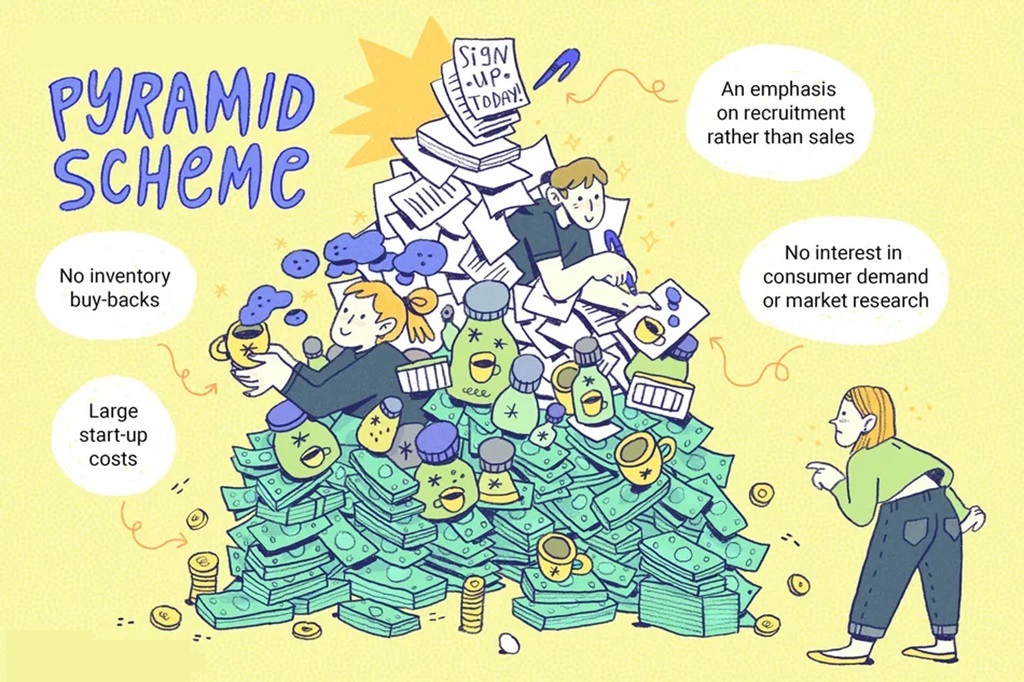

- Emphasis on Recruiting Over Products – Pyramid schemes focus on constantly recruiting new members rather than actually selling products or services that provide value. Beware of too much hype around expanding your “team.”

- Pay to Play Structure – Pyramid schemes require you to invest upfront, usually by purchasing products, to fully participate and move up. Legitimate businesses don’t force you to invest before earning profits.

- “Get Rich Quick” Vibe – Claims of making huge amounts of easy money should ring alarm bells. Pyramids lure you in with unrealistic expectations of overnight wealth.

- Lack of Transparency – Pyramids won’t provide detailed information about their business practices or products upfront. Look out for vague language about “amazing opportunities.”

- High Pressure Recruiting – Pyramid schemes push new members to constantly recruit all their friends and family. This helps expand the scam rapidly before problems surface.

- Complex Commission Structure – Pyramids masks their true nature with convoluted payout systems based on recruitment that make the actual economics hard to decipher.

It’s crucial to stay skeptical and beware if an opportunity sets off alarm bells around these shady practices. Whether you’re considering an investment or a business venture, it’s essential to ask lots of questions and do your homework before committing any time or money.

For example, if you’re wondering is northwestern mutual a pyramid scheme, a reputed financial services company, it’s important to explore if there are any claims or evidence suggesting it might be a pyramid scheme. It’s better to be well-informed and cautious to protect yourself from potential risks.

Tips to Avoid Pyramid Schemes

Here are some tips to protect yourself from predatory pyramid schemes and avoid their traps:

Do Thorough Research

Take time to carefully investigate any business opportunities before joining or investing money. Search online to uncover warnings, complaints, and legal actions. Consult objective third party sources rather than promotional materials.

Watch Out for “Pay to Play”

Avoid any programs that require large upfront investments or payments just to participate and move up. Legitimate businesses allow you to earn profits directly from your efforts, not by first paying fees.

Beware “Get Rich Quick” Hype

Maintain skepticism about claims that you can make huge amounts of easy money with little work. Ask for detailed documentation on income streams and the business model. Verify claims before investing.

Focus on Products, Not Recruiting

Look for companies centered on selling products/services rather than relentlessly pushing recruiting. Pyramids make money by expanding membership, not meeting real market needs.

Know Your Rights

Pyramid schemes are illegal. Report suspected scams to regulators. Also know your rights and recourse under law if you do become ensnared in a scheme.

Trust Your Instincts

Rely on your common sense. If something feels wrong or too good to be true, it probably is. Don’t ignore red flags just because friends/family seem excited. Protect yourself first.

Staying informed and acting with cautious skepticism is the best way to steer clear of pyramid scams without missing out on real opportunities. Evaluate all options rationally rather than jumping in under pressure or false hope of getting rich fast.

My Friend Joined a Pyramid Scheme – What Should I Do?

A difficult situation arises when someone close gets recruited into a pyramid scheme. You want to help and warn them, but their indoctrination into the scam makes them defensive and unwilling to listen. So what can you do to intervene in this situation? Here are some strategies:

- Approach Gently: Use empathy rather than attacks. Say you’re concerned they’re involved in something risky that will harm them and you want to understand why they joined.

- Ask Questions: Get them to explain exactly how the business works and where the money comes from. Identify logical fallacies gently without confrontation.

- Provide Information: Offer concrete resources like articles explaining pyramid scheme techniques and warning signs. But don’t overwhelm them initially.

- Appeal to Values: Remind them of their goals, principles and priorities. Point out how the scheme conflicts with those values.

- Avoid Guarantees of Failure: Express concerns rather than assurances they will fail. People are less defensive and more open to re-evaluating.

- Don’t Argue: Debates often cause people to dig in defending the scam to avoid contradicting themselves. Focus on asking questions rather than disputes.

- Don’t Invest Yourself: Refuse to invest money or recruit others, but explain you still care and want to maintain the friendship.

- Be Patient: Undoing brainwashing takes time. Let some distance pass and gently stay open to further conversations.

With the right approach of listening, caring and gradually providing countering information, you can potentially help people free themselves from a pyramid scheme’s hold before major harm is done.

Myths and Misconceptions About Pyramid Schemes

Unfortunately, several myths about pyramid schemes persist that can mislead people into joining or mistakenly believing they are legitimate ventures. Here are some of the major misconceptions worth debunking:

Myth: Pyramid schemes involve selling an actual product, so they must be legal.

Fact: Pyramid schemes often use products and services as an attempt to mask their true nature. But their profits really come from expanding recruitment rather than actual sales volume. Just having products does not make pyramid schemes legal.

Myth: As long as I make sales, it doesn’t matter if my downline recruits.

Fact: In pyramid schemes, your income is still tied to recruitment, not actual product sales. You may need to meet sales quotas just to qualify for rewards based on expanding your downline.

Myth: Pyramid schemes are short-lived, so you can make money if you join early.

Fact: While getting in early maximizes potential gain, all pyramid schemes eventually collapse, wiping out later participants. Being early doesn’t change the predatory nature.

Myth: Pyramid schemes are obvious and easy to spot.

Fact: Modern pyramid schemes use sophisticated tricks like vague language, complex pay structures and false identities to hide their scammy nature. Smart people still get fooled.

Myth: Participants bear all the blame since they were greedy/foolish to join.

Fact: Pyramid schemers are experts at manipulation techniques involving false promises, social pressure and isolation tactics. Victims are lured in through skillful psychological techniques.

Staying informed on the false narratives helps avoid being misled into complicity with pyramid scams. The underlying exploitative structure remains, regardless of any cover attempts.

Pyramid Scheme Case Study: Herbalife

A good case study on the fine line between legitimate MLM businesses and pyramid schemes is the company Herbalife. Herbalife sells nutritional supplements and weight loss products via individual distributors who can recruit sub-distributors and receive commission based on their purchases.

On the surface, Herbalife’s model is not that different from other MLMs companies like Avon or Amway. But concerns arose around signs of an underlying pyramid structure including:

- Distributors were encouraged to purchase large amounts of Herbalife products solely to qualify for commissions, rather than being based on actual resale volume. This indicates a pay to play structure.

- Recruiting new distributors appeared prioritized over actual retail sales to consumers, with rewards tied to expanding your downline.

- A majority of distributors made little to no profits after factoring in costs, with most revenues flowing upward.

- Aggressive recruiting tactics and cult-like indoctrination was reported at Herbalife training events.

After many complaints, the FTC eventually required Herbalife to restructure its model with clearer retail sales requirements and limitations on how distributors purchase product. However, critics still accuse Herbalife of relying too heavily on recruitment and operating as a pyramid scheme in practice.

This example demonstrates the complexity of determining if a MLM crosses into illegality. Carefully researching compensation structures and questionable practices remains important.

The Bottom Line

While pyramid schemes can seem tempting thanks to promises of easy money, the reality is participating almost always ends badly once the scam collapses. These predatory systems exploit dreams of wealth to funnel money to those at the top while leaving most people financially devastated in the end.

Protect yourself by learning to identify the warning signs of a fraudulent pyramid structure regardless of any legitimacy claims. And beware invitations from enthusiastic friends who have become recruits – well meaning people often get tricked into bringing loved ones into these damaging schemes. Maintain skepticism, demand transparency and think critically to avoid the seductive trap.

Steering clear of pyramid schemes may mean turning down some opportunities for fast cash. Discover the 10 most important business management tips for your venture, a valuable guide that not only enhances your strategic acumen but also spares you the much worse pain of losing significant time and money to an illegal venture doomed to eventually fail. By incorporating these tips and focusing your efforts into lawful and ethical businesses, you can pave the way for true financial freedom and fulfillment in your entrepreneurial journey.

Frequently Asked Questions

Are all MLMs pyramid schemes?

No, there are legal multi-level marketing companies. But some MLMs do rely too much on recruitment over actual product sales and operate as thinly disguised pyramid schemes, so careful analysis is required in each case.

How can you tell if you are in a pyramid scheme?

Warning signs include having to pay high upfront fees, pressure to focus on recruitment over products, complex commission structures only benefiting top levels, requiring large personal product orders, and lack of retail customers.

Are pyramid schemes completely illegal?

Yes, in the U.S. and most countries pyramid schemes are illegal and banned by the FTC because they are an unsustainable fraudulent business model. Participants can face legal penalties.

Can you make money in a pyramid scheme?

A few early members at the top do profit. But over 99% of participants entering later lose money, with massive losses once recruitment falters and the scheme collapses which is inevitable.

Why do people fall for pyramid schemes?

Pyramid promoters use false promises of wealth, social engineering tactics, and cult-like manipulation techniques to exploit people’s dreams of earning quick money and getting rich with little effort. Recruits let hope override critical thinking.

In Summary

While pyramid schemes employ complex financial structures, deceptive language and psychological tactics to convince people of their legitimacy, the underlying unsustainable, exploitative and fraudulent model means they will always eventually fail. Protect yourself by learning to identify the warning signs, resist the false hype, and focus your time and money on lawful and ethical business opportunities. Stay safe out there!