When it comes to protecting your precious vehicle, comprehensive insurance is a term you’ve likely come across. But what exactly does it entail? In this comprehensive guide, we’ll demystify the world of comprehensive insurance for cars and shed light on its importance and coverage. So, buckle up as we dive into the details.

Understanding Comprehensive Insurance

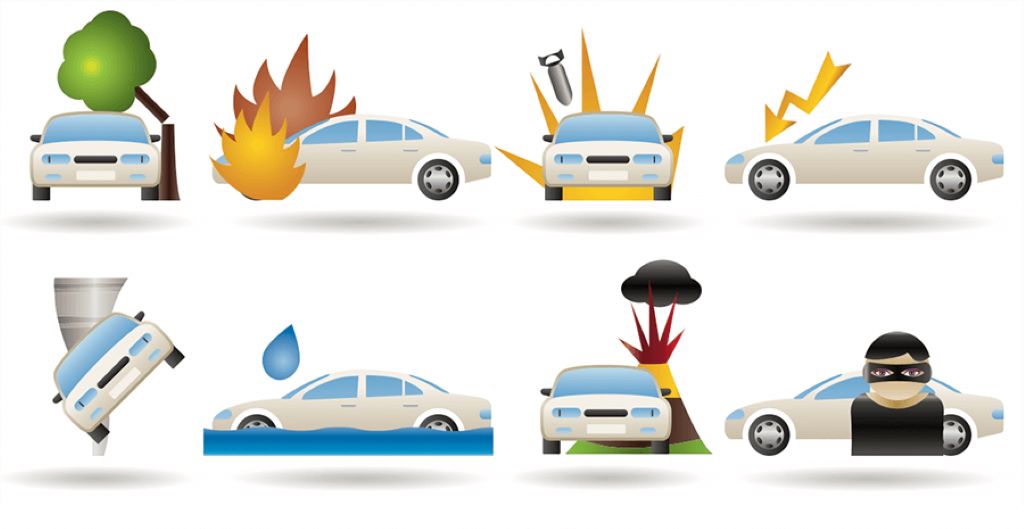

It’s important to have comprehensive insurance for your car, which includes coverage for incidents other than collisions. But did you also know about state farm engagement ring insurance? This type of coverage can give you peace of mind and protect you financially if your ring is lost, stolen, or damaged. It offers protection against damage to your car that occurs due to causes other than a collision. Let’s delve into the nitty-gritty of what comprehensive insurance typically covers:

Theft

Have you ever wondered what would happen if your car disappeared from your driveway overnight? Comprehensive insurance has got you covered. It steps in to mitigate your loss by providing compensation for your stolen vehicle.

Vandalism

Imagine waking up to find your car adorned with unsightly graffiti. With comprehensive insurance, the cost of repairs for such acts of vandalism is taken care of. It’s peace of mind knowing that even the unexpected is covered.

Fire

In the unfortunate event of your car catching fire, comprehensive insurance ensures that the financial burden of repairs or replacement is not on your shoulders. It’s a safety net that can save you from significant expenses.

Weather Events

Mother Nature can sometimes be unpredictable. Comprehensive insurance protects your car from various weather-related damages, such as hail dents, flooding, or falling trees. It’s your shield against the elements.

Animal Collisions

Encounters with animals on the road can be hazardous. Whether it’s a deer darting in front of your car or a small critter causing a collision, comprehensive insurance helps cover the repair costs.

Glass Breakage

A cracked or shattered windshield can compromise your safety on the road. Comprehensive insurance steps in to cover the expenses of repairing or replacing damaged glass.

Is Comprehensive Insurance Necessary?

Understanding why car insurance is so expensive is crucial, especially when considering that comprehensive insurance, typically optional, can become a necessity, as lenders often mandate it for those financing or leasing a vehicle. However, even if you own your vehicle outright, there are compelling reasons to consider comprehensive insurance:

- High-Theft Areas: If you live in an area with a high rate of car theft or vandalism, comprehensive coverage offers invaluable protection.

- Severe Weather Zones: Comprehensive insurance is particularly beneficial if you reside in regions prone to severe weather events like hurricanes, tornadoes, or hailstorms.

How Does It Work?

Now, let’s delve into the mechanics of how comprehensive insurance operates. When you file a comprehensive insurance claim, your insurer will typically cover the costs of repairing or replacing your car. However, there’s a catch – your deductible.

What’s a Deductible?

Your deductible is the initial amount you have to pay out of pocket before your insurance company kicks in. It’s like your financial contribution towards the repair or replacement of your car. Once you’ve met your deductible, your insurer takes care of the rest.

Real-Life Scenarios

To illustrate how comprehensive insurance works, consider these real-life scenarios:

- Car Theft: If your car is stolen from your driveway, comprehensive insurance will cover the loss, minus your deductible.

- Vandalism: Suppose your car becomes the canvas for an artist with spray paint. Comprehensive insurance will foot the bill for repairs, minus your deductible.

- Natural Disasters: When a tree falls on your car during a storm, comprehensive coverage ensures the damage is repaired without breaking the bank.

- Hail Damage: Hailstorms can wreak havoc on your vehicle. Comprehensive insurance comes to the rescue by covering the costs of repairs.

- Animal Collisions: Whether it’s a deer or a smaller critter, if you collide with an animal, comprehensive insurance ensures you’re not left with hefty repair bills.

- Glass Breakage: A rock shattering your windshield is a common occurrence. Comprehensive insurance takes care of the expense, minus your deductible.

Conclusion

In today’s ever-evolving world, protecting your car is paramount. Comprehensive insurance provides a safety net against a wide range of unexpected events, from theft to natural disasters. It’s not just an option; it’s a smart investment in your peace of mind.

Now that you’re well-versed in the world of comprehensive insurance for cars, take the time to explore your options and compare quotes from different insurance companies. Finding the best rate tailored to your needs is the final piece of this puzzle.

FAQs

- Is comprehensive insurance mandatory for all car owners?

No, comprehensive insurance is typically optional. However, lenders may require it if you are financing or leasing a car. It’s also a wise choice if you live in an area prone to theft, vandalism, or severe weather.

- Can I choose the amount of my deductible for comprehensive insurance?

Yes, you can often select the deductible amount for your comprehensive insurance policy. Keep in mind that a higher deductible may result in lower premiums but also means you’ll pay more out of pocket in the event of a claim.

- Will comprehensive insurance cover the entire cost of car repairs?

Comprehensive insurance covers the cost of repairs or replacement, minus your deductible. So, you’ll need to pay the deductible amount before the insurance kicks in.

- How can I lower the cost of comprehensive insurance?

To lower the cost of comprehensive insurance, you can consider raising your deductible, maintaining a good driving record, and installing anti-theft devices on your car.

- Can I add comprehensive insurance to an older car?

Yes, you can add comprehensive insurance to an older car. However, it’s essential to evaluate whether the cost of the insurance premiums justifies the value of the car in case of a claim.